FOR THE INVESTOR

BEST CANNABIS STOCKS TO BUY IN 2021

Not sure how to invest in pot stocks?

Here are six cannabis stocks picks that should see growth into the new year.

DEBRA BORCHARDT Updated: Feb. 11, 2021 8:10 am est | Original: Dec. 15, 2020

Weeding through cannabis stocks to find a good pick is getting easier. The greener field is now getting divided by flower and shake, as investors look at profitability and balance sheet stability.

Here are my top cannabis stock picks for 2021, based both on sprouting opportunities and results reported in the most recent quarter.

A Bigger Pot: Innovative Industrial Properties

The original cannabis real estate investment trust, Innovative Industrial Properties (IIPR) – Get Report continues to rack up more properties as cannabis companies tap real estate assets for cash.

As the leader in the cannabis real estate space, the company should continue to add to its portfolio of properties. I also expect it will keep delivering steadily increasing dividends, making this a solid choice for conservative cannabis investors.

And its numbers look good so far. The company reported total revenues of approximately $34.3 million for the third quarter. This was a 197% increase from the prior year’s third quarter. It also easily beat analysts’ estimates. IIP also recorded net income available to common stockholders of approximately $18.9 million for the quarter, or 86 cents per diluted share. The adjusted funds from operations (AFFO), meanwhile, were approximately $27.9 million, or $1.28 per diluted share. For perspective, net income available to common stockholders and AFFO increased by 205% and 192% from the prior year’s third quarter, respectively.

The company also has some $161.1 million in cash and cash equivalents and approximately $451.2 million in short-term investments, totaling approximately $612.3 million. The debt picture looks good, too. By quarter’s end, it had no debt, other than approximately $143.7 million of unsecured debt, consisting solely of 3.75% exchangeable senior notes maturing in 2024.

Believe in Trulieve

Florida-based Trulieve Cannabis Corp. (TCNNF) – Get Report has amassed a comfortable cash cushion, giving the company the ability to expand with ease. It could also handily beat the next quarter’s expectations and set the stock up for another move higher.

In addition to its cash and cash equivalents of $193.4 million as of Sept. 30, the company just reported revenue of $136.3 million for the third quarter. This beat analysts’ estimates. It also delivered a positive net income of $17.4 million, or 15 cents per diluted share, easily beating analyst estimates.

Further expanding its reach and solid footing, Trulieve has opened 73 dispensaries and achieved profitability in 2017. It has a 52% market share in Florida and is soon to be operational in Massachusetts.

The company is forecasting 2020 revenue to be in the range of $465 million to $485 million.

Mixing It Up in the Midwest: Cresco Labs

Cresco Labs Inc. (CRLBF) has cornered the Illinois market and will be able to command this market share for at least another year. The company got most multi-state operators to shift toward a limited license state strategy as a result of its success in Illinois.

Some 59% of Cresco Labs’ revenue comes from wholesale business — an area that many cannabis companies haven’t capitalized on. It has done this in Illinois and Pennsylvania, where the company has 100% wholesale penetration.

This has apparently helped the bottom line.

Cresco released its unaudited financial results for the third quarter ending Sept. 30, showing revenue hitting $153.3 million — a big jump over 2019’s third-quarter revenue of $36 million. Cresco attributed the increase in revenue to wholesale growth driven by an increase in harvests from expanded capacity in Illinois and Pennsylvania and strong growth in California. Retail growth was driven by strong sequential same-store growth and two new store openings in Illinois. It has also reported 178% same-store sales growth in its third-quarter year over year.

Rx for Growth: GW Pharmaceuticals

Each quarter GW Pharmaceuticals (GWPH) – Get Report is reporting increased prescriptions for Epidiolex, and the number of patients that keep renewing these prescriptions keeps growing. While no new products are expected in 2021, off-label uses may also lead to more sales of the drug.

Indeed, it’s seeing great results from this cannabidiol-based epilepsy drug. Total third-quarter net product sales of Epidiolex were $132.6 million and U.S. Epidiolex third-quarter net product sales were $121.6 million. Patients have been pleased with the drug and the number of prescriptions keeps rising.

The company reported total revenue of $137.1 million for the quarter ending Sept. 30, a big jump over the $91.0 million for the same time period in 2019. Net losses also fell to $12.2 million vs. last year’s net loss of $13.8 million for the same time period. In addition, the company said it had cash and cash equivalents of $480.3 million.

Cure for Burnt-Out Investors: Curaleaf

Despite Covid-19-related challenges in Massachusetts and Nevada, Curaleaf (OTC: (CURLF) ) has finally been able to recover from the closures in the Bay State. If Nevada tourism can come back, it will no doubt see those sales return, as well. With the addition of “Select” and “Grass Roots” sales to the revenue mix for 2021, Curaleaf is poised to have a great new year.

The business reported an impressive quarter and gave an even sunnier forecast. Current CEO Joe Lusardi said on the company’s most recent earnings call that it took a $25 million hit to revenue in the quarter, as a result of the pandemic (most tourist traffic in Nevada disappeared and the adult-use stores were closed in Massachusetts for weeks).

Now Lusardi is stepping away from the CEO role and handing it over to Joe Bayern on Jan. 1. Bayern joined the company in 2019 and led the Grassroots acquisition. Previously, Bayern served as president at INDUS Holdings, another cannabis company, and as chief executive and chief operating officer of the global beverage company VOSS of Norway.

This leadership change will come after Curaleaf delivered third-quarter managed revenue of $193.2 million, which grew 164% year-over-year. Total revenue came in at $182.4 million, a 195% year-over-year growth.

Seeing Green — Green Thumb Industries

Green Thumb Industries (GTBIF) is in some of the hottest states in the country already, and if New Jersey comes on board quickly, the company will be well-positioned to benefit. Green Thumb has consistently delivered on increasing revenues and is a reliable performer.

2021 Cannabis Industry Outlook: M&A, Capital Thaw and Global Opportunity

By Chloe Aiello

Published: January 12, 2021

After the tremendous political strides the cannabis industry made in 2020, 2021 has a lot to live up to. Experts and insiders agree the coming year could have a lot in store for the maturing cannabis industry, from acceleration of M&A and funding in the capital markets to continuing momentum toward legalization on the state level.

TRENDS

STRATEGIC M&A

Aphria and fellow Canadian cannabis giant Tilray, for example, announced in mid-December a $4 billion “reverse acquisition” to create the largest cannabis company by revenue. On the heels of the transaction, market research firm Viridian Capital Advisors remarked that the transaction “signals a new phase of Canadian market rationalization,” adding that there may not be mergers of similar magnitude in U.S. cannabis, but multistate operators will likely continue to expand capacity in newly-legal states and solidify positions in ones on the precipice of legalization through strategic transactions. Viridian also forecasted an acceleration in dealmaking, estimating the industry had a backlog of about $2 billion dollars in undisclosed deals heading into 2021.

ENTER THE CPGs

CAPITAL THAW

GLOBAL OPPORTUNITY

CASH HUNGRY STATES SEIZE THE MOMENT

BIPARTISANSHIP RULES

Jan 15, 20215:26

NY Gov. Cuomo Pledges to Legalize Marijuana, Cites Tax Revenue and Equity

Which cannabis companies are going to survive coronavirus?

Here’s how to tell

By Max A. Cherney | Published: April 20, 2020 at 1:26 p.m. ET

The sector was already shaky before COVID-19, but companies must now have the right mix of cash, pot and sales channels to make it to the other side

Bloomberg News/Landov

Before the outbreak of COVID-19, cannabis stocks had plummeted from fattened valuations as they failed to find promised profit and seemed at risk of bankruptcy. The global pandemic has made the situation even worse, and investors now are looking for companies that will simply survive.

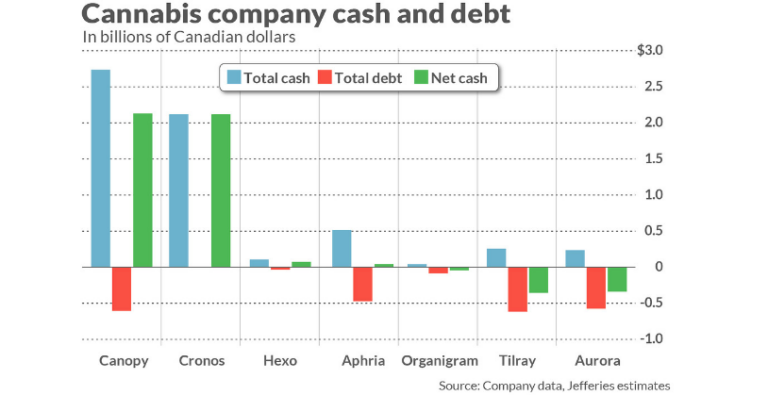

There are only two names in the legal-marijuana sector that investors can look to for relative safety. Some of the remaining companies may be safe, too, depending on how much cash they have, their stockpile of pot, retail access and their ability to make more marijuana products.

The two cash-rich companies are the easiest to pinpoint as able to make it through the pandemic. Canopy Growth Corp. WEED, +0.42% CGC, -0.13% has long had the strongest balance sheet, snatching up a $4 billion investment from Corona distributor and beverage giant Constellation Brands Inc. STZ, +1.43% in 2018. Executives have bled the war chest quarter-after-quarter, making questionable acquisitions and losing hundreds of millions on operational expenses. But under the leadership of freshly installed Chief Executive David Klein, Canopy has begun to rein in expenses and curtail operations in a move toward eventual profitability.

Read:From cash to ash: Pot companies have just months to live on average, study finds

Trading close to the cash value of the company divided by the number of shares, Cronos Group Inc. CRON, -0.67% CRON, -0.82% is seen by many investors MarketWatch spoke with as a relatively safe place to park money. It has $1.51 billion in cash, in large part due to tobacco-maker Altria Group Inc.’s MO, +0.13% investment.

“It’s a great defensive stock,” Raymond James analyst Rahul Sarugaser said in a phone interview with MarketWatch. “Given that it’s trading at just above cash, it’s effectively trading close to its bottom and anything [the company] announces will generate upside for investors.”

Even though Cronos is the second largest cannabis company in Canada, it doesn’t have much in the way of revenue or market share. Referring to Cronos Group’s lackluster sales, Cowen analyst Vivien Azer said in a recent note: “Who needs revenues, when you have cash?”

In the U.S., where access to capital has been harder due to the plant’s prohibited status under federal law, viability is even less certain. Without federal bailout money and with operations limited to 11 recreational markets and 33 medical states, it remains unclear which companies will survive.

On both sides of the border, companies face doom before the economic turmoil abates, but on a sliding scale based on how they rate in the following four areas:

Cash and profitability

Unlike other industries, weed companies were struggling to raise money well before coronavirus dried up potential investment. The market upheaval that has accompanied the COVID-19 pandemic makes a bad problem worse, according to Entourage Effect Capital managing partner Matt Hawkins.

“For more than a year now, we’ve had a distressed marketplace, for no other reason than it’s capital-starved,” Hawkins told MarketWatch.

The pandemic will exacerbate the issue, Hawkins said — companies with enough cash on the balance sheet or a road to profitability for 12 to 14 months will be able to weather the storm

“Cash is king, cash will continue to be king,” he said.

Don’t miss:Aurora Cannabis will roll up its shares in a reverse stock split — here’s what you need to know

There are several U.S. names that fit the criteria: Green Thumb Industries Inc. GTII, +6.69% GTBIF, +7.16% Trulieve Cannabis Corp. TRUL, -0.23% TCNNF, -1.08% and Curaleaf Holdings Inc. CURA, +1.58% CURLF, +0.39%, all have relatively strong balance sheets.

Jefferies analyst Owen Bennett agreed. Until now, Bennett and his team did not assign cash too much weight when determining an investment thesis, but, “we think that going into a recession, it can’t be ignored.”

Cash is also important now because it’s hard to get. Bennett pointed to Tilray Inc.’s deeply unfavorable $90 million equity sale in March, which represented a 66% discount to the company’s average price.

According to a hedge fund portfolio manager who invests in the cannabis industry, there are two broad groups of cannabis companies: those with liquidity in their stock, which means they will be able to raise more cash, and illiquid companies, which include many companies listed on junior exchanges. For the second group, the scenario is “worse than ever,” he said.

Stockpiles of Weed

Once considered to be an albatross around the neck of Canada’s largest producers, excess inventory is now desirable.

According to a note from Jefferies’ Bennett, companies with immense inventory will be at an advantage if there are supply shutdowns, in terms of cash flow, much like producers with a large capacity benefited during the early days of recreational legalization in Canada.

Raymond James analyst Sarugaser said his bank has observed a cultivation and processing slowdown across the industry as weed companies implement social-distancing measures and spend more resources ensuring clean work places.

“Now, it seems that large accumulated inventories may prove to be an indicator of resilience during the COVID-19 era,” Sarugaser wrote in a recent note.

Production Capabilities

Companies without a lot of product on tap must grow it. But growing, processing and transforming cannabis into products, whether that means packing flower for smoking or making products such as edibles or vapes, is now more complex because of the different way companies must operate during the pandemic.

See also:As cannabis industry stays largely quiet on coronavirus, this CEO has been sounding the alarm

Few major producers have made public disclosures or reported financial results since March. Aurora Cannabis Inc. ACB, -0.29% ACB, has long touted the level of automation at its flagship Aurora Sky facility in Alberta: “The level of automation at Sky-class facilities is definitely an asset at all times in terms of increasing the reliability and efficiency of our operations,” a company spokeswoman told MarketWatch for this story.

Other cannabis companies have said little about the effects of social-distancing and other safety measures on their cannabis production.

Mitch Baruchowitz, managing partner at Merida Capital Partners, a cannabis-focused private-equity firm, said the larger U.S. multistate operators such as Cresco Labs, Green Thumb and Curaleaf already have a fair amount of automation and an advantage over smaller operators who still rely on human labor for various aspects of cannabis production.

One other advantage shared by all cannabis companies is that they are forced to operate wall-to-wall within states, and tend to source production inputs such as soil and other raw goods from local vendors, Baruchowitz said.

In Canada, as a second generation of cannabis product sales begins in earnest — including edibles, vapes and drinks — companies that already have products on the market are at a distinct advantage, according to Sarugaser. Weed businesses that were formulating new products will be delayed because it will be impossible for companies to set up production lines, refine the products and complete quality assurance testing, among other things, while the emergency measures are in place.

Read:Aphria yanks forecast due to coronavirus after strong increase in cannabis sales

Retail Channels

One of the longstanding excuses for lackluster sales that Canada’s largest cannabis companies have given investors is that bricks-and-mortar pot stores have been slow to open. Ontario has received the lion’s share of the criticism, but other provinces have had their issues too. As Canada responded to the pandemic, Ontario again befuddled investors: across most of the country and in the U.S., weed wass considered an essential business. But Ontario shut down stores, only to reverse course days later and allow curbside pickup or delivery for the 52 open stores — though the online government-run pot store was always open for business.

“In sum, we see the stalling of in-person cannabis retail as one of the key mechanisms holding the Canadian cannabis market back from expending toward market equilibrium and further accelerating the attrition of the poorer operators,” Sarugaser wrote.

While curbside pickup presents its own complications for cannabis retail operators, Canopy Growth has shut down its corporate-owned pot stores in an abundance of caution, while other retailers remain open.

See also:Pot smokers stock up for pandemic on ‘the vice of choice when alone’

In the U.S., in every state where recreational pot is legal, cannabis is considered an essential business and sales continue to hum along — albeit with the required social distancing, delivery, or various click-and-collect systems in place.

That’s apart from Massachusetts. There, the governor has shut down all recreational cannabis operations, saying that because it is one of the few states in the northeast with legal pot, he is concerned people will travel from out of state to buy weed and potentially spread the virus. The decision doesn’t look likely to change, as a legal challenge to the governor’s order was defeated this week.

Companies with exposure to Massachusetts retail such as the Illinois-based Cresco Labs Inc. CL, +5.23% CRLBF, +4.82%, Green Thumb and Curaleaf stand to suffer.

Top Marijuana Stocks That Pay Dividends

Updated Feb 1, 2020

When most people think of marijuana stocks, the last thing they think of is dividends. For the most part, this is an accurate characterization. The legal marijuana industry is still very young, and new companies in growing industries need money to expand. Therefore, they don’t have excess capital to pay out as dividends. This doesn’t instantly make them bad investments; it just means that as a shareholder you are hoping to make money through capital appreciation (a rising stock price) as opposed to dividend income in the near term. Furthermore, U.S. investors in the marijuana space tend to currently focus on a handful of Canadian companies which have enjoyed the opportunity to list on U.S. exchanges.

Some investors love dividend stocks, and lucky for those investors there are a few companies in the cannabis industry that pay dividends or that have paid them in the past. These are the top dividend-paying marijuana stocks. All figures are as of January 31, 2020.

AbbVie Inc. (NYSE: ABBV)

AbbVie Inc., the manufacturer of Marinol (dronabinol), has been paying quarterly dividends consistently since the company was spun off from Abbott Laboratories in 2013. The company remains one of the most popular marijuana pharmaceuticals developers. Recently, the company revealed a positive opinion by the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency for a potential drug treatment for certain types of leukemia.1 At the time of this writing, AbbVie’s annual dividend yield was 5.67%. The company’s next dividend of $1.18 is set to be paid on February 14, 2020.

Associated British Foods Plc. (LON: ABF) (OTC: ASBFY)

Although Associated British Foods’ main business is the processing and manufacturing of food, their wholly owned subsidiary British Sugar cultivates cannabis for the production of GW Pharmaceuticals’ Epidiolex. The company has been paying semi-annual dividends consistently (as is British custom, versus the U.S. standard of quarterly payments) for at least the last 18 years. At the time of this writing, Associated British Foods’ annual dividend yield was 1.67%. The company’s most recent dividend was £0.117 per share (~$0.15) and was paid on July 6, 2018.

Aurora Cannabis Inc. (ACB)

Major cannabis producer Aurora Cannabis Inc. completed the open market sale of its Australis Capital unit in November of 2018. While Aurora has not paid a traditional dividend to investors as of this writing, the spin-off of Australis yielded a somewhat similar result. Effectively, the sale of Australis represented a roughly 1% one-time dividend for shareholders.

Compass Diversified Holdings Inc. (NYSE: CODI)

Compass Diversified Holdings owns a majority interest in hemp food producer Manitoba Harvest. At the time of this writing, Compass Diversified Holdings’ annual dividend yield was 6.06%. The company’s most recent dividend of $0.36 was paid on January 15, 2020.

Innovative Industrial Properties Inc. (NYSE: IIPR)

NYSE-listed cannabis real estate investment trust (REIT), Innovative Industrial Properties started paying a dividend in 2017. REITs are commonly associated with dividends because they are generally required to pay them to retain their tax status as a REIT. Unlike other companies that are subject to double taxation (meaning earnings are taxed at the corporate level, and taxed again when investors get them as dividends), REITs generally don’t pay corporate income tax as long as they pay out at least 90% of their taxable income as dividends. This means the income is only taxed once. Shareholders pay income and/or capital gains taxes on their REIT dividends depending on the nature of the income from the REIT.

Innovative Industrial Properties Inc. pays a 4.25% dividend yield. The company increased its quarterly dividend to $0.45 in March of 2019, to $0.60 on July 15, 2019, and to $0.78 per share on October 15, 2019. Most recently, on December 30, 2019, the company announced a dividend of $1.00 to be paid on January 15, 2020.

Invictus MD Strategies (TSXV:IMH) (OTC:IVITF)

Invictus MD Strategies Corp. doesn’t have a regular dividend, but we included it here because the company has paid one in the past. The company is a platform of licensed cannabis producers across Canada. In the fall of 2016, Invictus MD paid a CAD $1,000,000 dividend (~0.108/share) after profitably exiting some investments.

Iwasaki Electric Co. Ltd. (JPX: 6924)

Iwasaki Electric Co. Ltd. is an electronics company focused on specialty lighting applications. Iwasaki Electric’s wholly owned subsidiary Eye Hortilux is a designer, manufacturer, and marketer of grow lights targeted at cannabis cultivators and more. At the time of this writing, Iwasaki Electric’s most recent dividend was 40¥ a share (USD 0.35), with an ex-dividend date of March 27, 2019. Based on this, the company’s annual dividend yield is 2.04%.

Scotts Miracle-Gro Company (NYSE: SMG)

Scotts Miracle-Gro is helping gardeners with a different kind of “grass”: marijuana. Although the company doesn’t “touch the plant,” Scotts has invested heavily in the space. In 2015, the company’s Hawthorne Gardening Co. subsidiary purchased General Hydroponics. Scotts Miracle-Gro also has a significant stake in the desktop hydroponics company AeroGrow International (OTC: AERO). The company’s most recent dividend of $0.58 per share is expected to be paid to investors on March 10, 2020. SMG’s annual dividend yield is 2.01%.

Source: Investopia

SHORTING CANNABIS STOCKS WAS A BILLION DOLLAR IDEA IN 2019

Published: Jan 3, 2020 6:57 p.m. ET

by Max A. Cherney

At Tuesday’s borrow rate, it would cost investors $2.8 million a day to short the entire sector, according to analysis of short selling in the sector

Though 2019 was a brutal year for weed stocks in Canada and the U.S., that meant it was a stellar year for short sellers, who harvested nearly $1 billion from shorting the top 20 cannabis companies according to a new analysis.

As the sector entered the year with big promises and fat valuations, quarter after quarter of results that did not live up to the expectations set by the companies themselves sent weed stocking plunging. The Horizons Marijuana Life Sciences Index ETF HMMJ, -0.58% fell 43% in the past year and the ETFMG Alternative Harvest ETF MJ, -1.01% dropped 36%, while the S&P 500 index SPX, -0.71% has gained 32% in the past year.

Short sellers collected total mark-to-market profits of $993.3 million, according to research released late Friday by S3 Partners Managing Director Ihor Dusaniwsky. Shorting Aurora Cannabis Inc. ACB, -0.99% ACB, -1.14% through the year would have yielded the most profit, with investors banking $264.8 million, S3 found. Cronos Group Inc. CRON, -3.12% CRON, -2.62% netted shorts $217.1 million and Tilray Inc. TLRY, -2.38% gave investors a profit of $174.3 million.

Among the major licensed producers in Canada, only Aphria Inc. APHA, -0.80% APHA, -1.38% generated a total loss for shorts last year, of $65 million. Organigram Holdings Inc. OGI, -2.58% OGI, -0.44% also generated a net loss for shorts, but just barely: nearly $600,000.

Investors looking to jump into a short position now will pay handsomely to do so. The average cost to borrow stock across the entire sector is 26.5%, and 30.5% among the top 20 names, costing about $2.8 million a day or $1.01 billion at those rates. The top 20 names make up nearly 90% of all the weed stocks investors are borrowing to short.

“High stock borrow fees in most of the cannabis stocks are taking a large bite out of mark-to-market profits and discouraging increased short selling in the sector,” Dusaniwsky wrote. “If any stock rallies significantly, the chances of a single stock squeeze are higher than in most other sectors in the market due to these high stock borrow fees.”

Read: ‘CBD has the potential to harm you,’ FDA warns consumers

The most expensive stocks to short are Hexo Corp. HEXO, -4.27% HEXO, -4.21% , which carries a 66% borrow fee in the U.S., and Tilray, which carries a 59% borrow fee. Canopy Growth Corp. CGC, -1.14% WEED, -1.15% had the most short interest at $1.23 billion, which amounted to 26% of the float. Its borrow fee was 52%.

Dusaniwsky also added that without more hedge funds and long only managers investors should continue to expect concentrated shorting of a few stocks, high borrow costs and the risk of a short squeeze if the supply available for loan decreases.

Don’t miss: Cannabis stocks slammed as analysts say Canopy’s new CEO faces big challenges

Financial technology and analytics firm S3 Partners follows 243 cannabis companies with a combined market valuation of $86 billion.

Stocks to watch

MARIJUANA STOCKS TO THIN OUT IN 2020– THEN COMES THE REALLY TRICKY PART

by Bill Peters | 12/26/2019

Following 2019’s collapse in marijuana stocks, some of the most well-known pot companies in the U.S. and Canada just don’t have enough money in the bank to get through the next 12 months without big changes, some analysts estimate.

Last year was a bubble year of money-raising and boilerplate talk of “disruption.” But if 2019 was the year marijuana stocks’ bubble popped, 2020 seems likely to be the year when investors have to pick through, and make sense of, whatever smaller industry remains on the other side after companies go under or get sold for parts.

The cleanup won’t end there. Figuring out how to dismantle companies that run out of cash in 2020 will be just the start of a new, separate drama.

More industry observers wonder what recourse — in court or otherwise — cash-thin companies will have as doors to financing slam shut and debt comes due. With private equity circling, they also wonder whether a bigger sweep-up of “distressed assets” is coming.

During a marathon four-hour panel with Cowen & Co. at MJBizCon this month, there was talk of “those of us that make it through the next 12 months.”

Also at the marijuana industry’s biggest event, Codie Sanchez, managing director at cannabis private equity firm Entourage Effect Capital, said companies needed to make sure they had 12 months of cash on hand “to weather the storm.“

“There will be a distinction that will become increasingly obvious, I think, over the next 12 to 24 months,” Cam Battley, Aurora Cannabis‘ (ACB) then-chief corporate officer, said in an interview at the conference in Las Vegas’ Cosmopolitan hotel. “And we will end up at the end of that period with a smaller number of cannabis companies in Canada, in the U.S., and perhaps other parts of the world than we have today.”

A little more than a week later, Aurora said that Battley had left that position. Aurora cannabis stock sank on the news, amid questions surrounding an abrupt departure.

Marijuana Stocks And Available Cash

Even as marijuana stocks continued their exodus lower, some companies are still sitting on a good deal of cash. Cronos Group (CRON) has nearly 15 years’ worth, and Canopy Growth (CGC) has enough to last four-and-a-half years, based on an MJBiz Investor Intelligence analysis. Last year, tobacco giant Altria (MO) invested $1.8 billion in Cronos, and alcohol giant Constellation Brands (STZ) invested $4 billion in Canopy.

(HEXO) and Tilray (TLRY) had 1.2 years’ worth, according to MJBiz Investor Intelligence. CannTrust (CTST) and Aurora Cannabis (ACB) had more than a half-year’s worth.

MedMen (MMNFF) had less than four months’ worth of cash coverage, the analysis found. The company has laid off staff and tamed its multistate ambitions to cut costs. The California-based retailer, however, has a $250 million credit line from private equity firm Gotham Green Partners. But that arrangement has raised questions about how much the private equity firm might control MedMen’s fate. Cronos CEO Mike Gorenstein co-founded Gotham Green.

Acreage Holdings (ACRG), the U.S. cannabis company backed by former House speaker John Boehner, had less than three months. Acreage declined to comment on the analysis. The company has an agreement to sell some properties to a real estate investment trust and then lease them back. That deal, it said, has helped its financial situation.

During its most recent earnings call in November, Acreage said it planned to go “broader and deeper” in every state where it operates. But Acreage’s last quarter was the second in a row during which it did not open any new stores, as it works through regulatory snags in some states. Management in November said it had three completed dispensaries in Massachusetts and one in Michigan. Those are awaiting the OK from regulators.

Marijuana Industry Eyes ‘SAFE’ Haven

To gauge a company’s cash coverage, the MJBiz Investor Intelligence analysis looked at Factset’s operating-cash-flow and capital-expenditures forecasts for the next fiscal year, along with debt due in 2020. It compared that to a company’s cash on the balance sheet as of Dec. 17.

The analysis didn’t factor in big lines of credit. Such loans are rare for the industry as traditional banks stay away.

Congress is trying to change that with the Secure and Fair Enforcement Banking (SAFE) Act, which would allow the cannabis industry to access banking and financial services. The House passed the bill in September, but its prospects are dimmer in the GOP-controlled Senate. Last week, Senate Banking Committee Chairman Mike Crapo, R-Idaho, said he opposes the SAFE Act but is open to amending it to address his concerns.

Meanwhile, companies are finding other ways to obtain cash. Curaleaf (CURLF) last week said it secured $275 million in financing in a syndicated loan provided by institutional buyers. In November, Executive Chairman Boris Jordan said Curaleaf expected to have “very good financing” to announce later in the year. If that didn’t go through, he added that “the large shareholders of the company are more than happy to provide the financing” to seal any deals.

Other Questions For Marijuana Stocks

In addition to the cash crunch, Entourage Effect’s Sanchez said companies need to address three other questions: Are they profitable or do they have a path to profitability? Do investors consider the company one of their top investments? Can they keep up sales even as cannabis turns into more of a commodity?

If the answer isn’t yes to those questions, they might need to think about merging or selling assets.

She could see her firm moving in to turn more “distressed” companies around. Entourage, she said, had two staff members with experience in handling distressed companies. They also had two people who had been entrepreneurs themselves who have pulled companies back from bankruptcy.

At a presentation late last year, she recalled putting up a large sign that said, essentially, prepare for the downturn.

“Because it’s totally irrational how these companies are valuing themselves and what multiples are,” she said at MJBizCon. “The only difference for us is that, now, companies are sort of listening to that.”

Bankruptcy Protection For ‘Illegal Drug Money’?

But since cannabis is still federally illegal, the industry — at least the part of it that directly handles the plant itself — doesn’t have the bankruptcy protections that other businesses do. For companies that don’t directly handle pot, the gray areas are still wide.

“You’re basically asking a federal court to approve a plan that would be funded by what is, in the eyes of the federal government, illegal drug money,” Jonathan Robbins, chair of cannabis practice at the law firm Akerman, said over the phone.

Even ancillary service providers, he said, aren’t guaranteed protection. For landlords that serve the industry, for instance, “the money that would be paid to creditors is still money coming from the marijuana industry. And that’s the dilemma.”

Robbins said other alternatives, albeit weaker ones than federal bankruptcy protection, were still available for the industry. Companies could seek receivership, where a court appointee steps in to oversee company assets and decisions. Assignments for the benefit of creditors, an option similar to bankruptcy, is also available in Florida and other states.

Marijuana Stocks Face Low Prices, Illegal Rivals

Executives dispute the ever-more-audible doom-saying about the marijuana industry. At MJBizCon, a slide during a presentation by equity analysts Craig Behnke and Mike Regan showed the ups and downs of Amazon‘s (AMZN) stock during its two-plus decades as a public company. Amazon shot out of the gate following its debut. Then, it stabbed lower amid the dot-com bust. But it climbed steadily afterward.

“AMZN Timing Right, Then Wrong, Then Right,” the heading of that slide read.

Battley, during the Cowen panel, said that the current industry disarray “not only had to happen,” but was healthy.

But marijuana stocks must still grapple with the reality that much of the demand in the U.S. and Canada has stayed on the illicit market. After years of trying to get high fashion to rub off on cannabis — via $13,000 gold pipes and other accessories — more companies are rolling out low-priced weed to compete.

Canopy, Tilray and Hexo are now launching low-priced weed brands as illegal cannabis keeps prices low. But management for Aurora Cannabis, during its most recent earnings call, said “value brands,” in some cases, were really just “dumping-inventory” brands.

As prices tumble, others warn of the spillover effects up the supply chain. Michael Townsend, co-founder of Hemptown, a hemp cultivator and manufacturer, said more hemp farmers were likely to go bankrupt in 2020. A rush to buy cheap seeds left farmers and processors alike holding weak product. Legal disputes between both sides seem likelier to erupt.

Farmers initially planted when prices of hemp were higher, Townsend said. When it came time to harvest, however, prices caved, as supply flooded the market in an effort to ride the CBD craze. That could make already-high harvesting costs far more difficult to deal with — and potentially not worth it at all.

“I think a lot of farmers are just leaving the hemp in the field,” he said, “and they’ll till it under when it’s rotten.”

YOU MAY ALSO LIKE:

Stock Market Forecast 2020: Clear Skies From Fed, China Trade But Election Looms

Marijuana Stocks To Buy And Watch

Is Canopy Growth Stock A Buy Right Now? Here’s What Earnings, Charts Show

Catch The Next Big Winning Stock With MarketSmith

Best Growth Stocks To Buy And Watch

Source: Investors Business Daily

Stocks to watch

THE CANNABIS WORLD CONGRESS AND BUSINESS EXPO

This Best-In-Class Expo Is THE Place To Be For Cannabis Industry Professionals

ABOUT THE CANNABIS WORLD CONGRESS

CWCBExpo’s mission is to work with the cannabis industry to legalize, educate, strengthen, expand and help legitimize the cannabis industry.

The Cannabis World Congress & Business Exposition is a business-to-business trade show event for the legalized cannabis industry. It is held 3 times per year in the largest media, financial, and business markets: New York, Los Angeles, and Boston. It is the leading forum for dispensary owners, growers, suppliers, investors, medical professionals, government regulators, legal counsel, and entrepreneurs looking to achieve business success and identify new areas of growth in this dynamic and fast-growing industry.

ATTENDEE PROFILE

Attendees at the Cannabis World Congress & Business Expo are highly qualified professionals and entrepreneurs:

- Employed in the cannabis industry

- Interested in starting a cannabis business

- Private equity & investment resources

- Provide professional or business services

These attendees will represent all segments of the Cannabis industry:

- Accounting & bookkeeping firms

- Consulting services

- Delivery services

- Dispensaries

- Edibles producers

- Federal, state and local governments

- Grow sites & facilities

- Hemp producers & distributors

- Infused products producers

- Law enforcement

- Legal services

- Licensed retail stores

- Hospitals, clinics and other healthcare facilities

- Private equity firms

- Regulatory enforcement agencies

- Security & safety services

- Smokeshops & headshops

These attendees will be looking to purchase or invest in a broad scope of products and services:

- Accounting & insurance services

- Advertising & marketing agencies

- Banking & payment processing services

- Botanicals

- Containers, bottles and packaging

- Dispensing & vending machines

- Displays & fixtures

- Grow lights

- Hemp products

- Hydroponics & cultivation products

- Infused edibles & beverages

- Inventory tracking

- Lawyers & legal resources

- Licensing services

- Medical resources

- Paraphernalia (headshop & smokeshop goods)

- POS & management software

- Private equity & investment resources

- Professional training & education

- Security services & equipment

- Seed banks

- Testing & lab services

- Tinctures, tonics and topicals

- Vaporizers

And more…

CANNABIS WORLD CONGRESS INFORMATION AND POLICIES

THC Policy

The consumption and sale of THC products is strictly prohibited by CWCBExpo and is not allowed at any of the CWCBExpo events. We strongly encourage attendees, exhibitors, speakers, and press to adhere to the venue regulation as well as local, state, and federal laws.

Age Restriction

No one under the age of 18 may register and attend the CWCBExpo.

TO LEARN MORE, GO TO: CWCBEXPO.com

Cronos paid $300 million for a small CBD company, and CEO’s private-equity firm stands to collect $120 million of it

by Max A. Cherney

Published: Nov 5, 2019 12:07 p.m. ET

When Canadian cannabis company Cronos Group Inc. bought U.S. CBD startup Lord Jones for $300 million, the deal was noteworthy for two reasons: (1.) that the acquisition price was equal to 75 to 150 times the young company’s 2018 revenue of between $2 million and $4 million, according to a person familiar with the matter, and (2.) that a fund co-founded by Cronos’s CEO and a longtime director stood to collect 40% of the purchase price, including more than $20 million in fees.

Cronos CRON, +0.80% CRON, -7.42%, one of Canada’s five biggest licensed cannabis producers, announced the acquisition of the 2-year-old startup in August.

As cannabis market leader Canopy Growth Corp. has attracted a $4 billion investment from beer, wine and spirits giant Constellation Brands STZ, -0.25%, Cronos has a $1.8 billion investment from tobacco company Altria Group Inc.MO, +0.10%, arming it with a war chest to fund acquisitions and grow its business. Altria paid that sum to acquire a 45% stake in Cronos along with warrants that, if exercised, would raise that stake to 55%. The investment, made in December of 2018, gave Altria an exclusive partnership in the cannabis sector just months after Canada fully legalized weed.

Cronos’ CEO, Michael Gorenstein, and board member Jason Adler also have a private-equity firm called Gotham Green Partners that paid $12.8 million for a 40% stake in Lord Jones, according to a document reviewed by MarketWatch. Gotham Green used the document as what a cannabis industry investor described as a “pitch deck” for potential investors in one of its funds. Gotham Green stood to make $21 million in fees, based on the management-fee structure outlined in the document, from a $107.2 million profit on the increase in value of Lord Jones shares. Gorenstein and Adler recused themselves from the negotiations, which were conducted by a special committee, the majority of which were Altria appointees, according to a filing with the Canadian regulator.

According to another filing with Canadian regulators, Gotham Green’s Goreinstein disclosed receiving roughly $23 million in Cronos stock — 40% of the stock included in the deal, which was $225 million in cash and $75 million in stock — identifying it as “related to an acquisition or disposition pursuant to a takeover bid or acquisition” on Sept. 5, the day the Lord Jones acquisition closed.

“In connection with the transaction Gotham Green will receive consideration commensurate with its ownership stake in Redwood,” Cronos spokeswoman Anna Shlimak wrote in an email to MarketWatch. “Like all general partners in Gotham Green, Mike Gorenstein will be compensated accordingly.”

Lord Jones sold $2 million to $4 million in CBD products in 2018, according to a person familiar with Lord Jones’s revenue, which would mean the deal was worth 75 to 150 times the startup’s annual revenue for the most recently completed year. Cronos has not released financial information about Lord Jones and did not comment on its revenue.

A person familiar with the private company’s revenue said that its sales will grow “significantly” from that total this year, declining to elaborate further. Another person familiar with Lord Jones revenue said it achieved a monthly run rate of $2 million around the time Cronos announced its intention to buy the company.

Lord Jones — founded in 2017 by California married couple Robert Rosenheck and Cindy Capobianco — approached Cronos for the sale, after its co-founders decided that it needed a partner to expand the business, a Cronos spokeswoman said in an email to MarketWatch.

For more: Cronos CEO on Altria deal, weed drinks and the rise of CBD

The special committee negotiated the deal and voted unanimously in favor of it, according to Cronos. Altria signed off on the transaction, as is required of any deal in which Cronos engages that is valued at more than C$100 million ($76.6 million), according to the company’s rights agreement.

“We believe that with this investment Cronos is well-positioned in the rapidly growing U.S. hemp-based CBD products category,” Altria spokesman George Parman said in an email message. Altria declined to comment on the multiple, referring questions to Cronos, which declined to comment.

Lord Jones sells CBD products such as beauty and skin-care products, tinctures and edibles abroad and in the U.S., at such retail outlets as Sephora and the Standard Hotel, according to the document.

See also: Three things you need to know about CBD

The price Cronos agreed to pay for Lord Jones appears higher than the valuations other investors have granted larger companies interested or involved in the CBD-products business. Tilray Inc. TLRY, +1.05% bought hemp-products maker Manitoba Harvest for up to C$419 million, with plans to launch a line of CBD products. Manitoba Harvest has a mature hemp business with C$94 million in 2018 revenue, resulting in a narrower price-to-revenue multiple than Lord Jones’s apparent valuation on this basis.

Charlotte’s Web Holdings Inc. CWBHF, +8.38% CWEB, +8.14% is the largest CBD-focused public company by market value at $1.25 billion, roughly 18 times its 2018 sales of $69.5 million. PI Financial analyst Jason Zandberg said companies that are focused on CBD, such as Charlotte’s Web, in general trade at higher multiples versus their counterparts involved in marijuana.

Zandberg wrote in an email that current sales multiples for U.S. cannabis companies are 2.7 times full year 2020 revenue for the largest marijuana companies, 1.4 times sales for mid-size weed businesses and 0.9 times revenue for the smallest. Private companies are typically discounted 40% to 50% versus public revenue multiples, “but in the current selloff that discount has narrowed (hard to put an exact figure given the lack of data points),” Zandberg wrote.

According to CB Insights, a “reasonable” multiple for an acquisition in consumer packaged goods is roughly three times revenue.

Don’t miss: Cannabis producer Hexo shutting down facilities amid deep staff cuts

In an email, Cronos spokesman Shlimak told MarketWatch that “the multiple Cronos Group paid is consistent with similar transactions that have been announced in our space and aligned with relevant publicly traded cannabinoid/CBD peers.”

Beyond Cronos and Lord Jones, Gotham Green has spread more than $350 million across the cannabis sector, according to the document reviewed by MarketWatch, investing in a range of public and private companies involved in biotechnology, branded products, hardware, CBD, hemp, cultivation supply, retail, vertically integrated companies, lab testing, distribution, software and e-commerce, technology. Gotham Green did not return an emailed request for comment.

In the pitch deck, Gotham Green describes itself as a private-equity or venture-capital firm established in 2017 to “capitalize on market inefficiencies and the absence of traditional funding sources across the global cannabis industry.” The firm’s most recent investment vehicle has raised $215 million of a targeted $300 million, and deployed $93 million as of August. As part of its investment in Lord Jones, Gotham Green gained two board seats at Lord Jones and offered “critical input into governance and business growth objectives.”

See also: Aphria profit didn’t come from selling marijuana

The document MarketWatch reviewed do not name or describe Gorenstein as involved with Gotham Green, but Cronos filings say he is a co-founder and “member” of the investment firm. The document describes Adler as the founder and managing member of Gotham Green and the “chief architect” of Cronos. Adler did not return emails seeking comment.

The co-founders of Gotham Green “orchestrated the takeover, corporate reconstitution and operational overhaul of Cronos Group Inc., which served as the predecessor to the formation of Gotham Green Partners,” according to the document.

CBD is a nonintoxicating compound found in the cannabis plant that is widely believed to have wellness properties. Canadian cannabis companies are hoping the substance may give them an early pathway into the American market, where cannabis remains illegal at the federal level.

But CBD is used by GW Pharmaceuticals PLC GWPH, +2.26% in its Epidiolex, a treatment for certain forms of epilepsy, and the U.S. Food and Drug Administration categorizes it as a drug. The FDA has said companies are not allowed to add CBD to food or drinks or to make health claims, as the agency works to come up with a regulatory framework.

“Before [CBD companies] have a big run in sales, the air needs to clear,” Zandberg said.

CBD is nonetheless showing up in a host of consumer products such as protein powders, bath salts, makeup and even jelly beans. Though many scientists are unsure of exactly what, if any, the benefits are, U.S. sales of CBD products may pass $1 billion this year and $10 billion in 2024, according to a forecast for Hemp Industry Daily.

U.S.-shares of Cronos, which trade on the Nasdaq, have declined more than 20% this year, as the ETFMG Alternative Harvest MJ, -0.60% has dropped 15% and the S&P 500 index SPX, +0.95% has gained more than 21%

Stocks to watch

CONSUMER DEMAND:

WHAT'S HAPPENING IN CBD BEAUTY, BUSINESS & INVESTING

FINANCIALNEWSMEDIA.com NEWS COMMENTARY

Major retailers are just beginning to embrace CBD thanks to sizable consumer demand. To date, Neiman Marcus, Sephora, Vitamin Shoppe, Kroger, Barney’s DSW, CVS, and Walgreen’s have all jumped at the opportunity. American Eagle just became the latest retailer to sell CBD, too. In fact, it just struck a deal with Green Growth Brands to sell CBD products in more than 500 stores and online, with sales expected to begin by October 2019. All of that is opening a wide range of opportunity for companies including The Yield Growth Corp. (OTCQB: BOSQF) (CSE: BOSS), HEXO Corporation (NYSE: HEXO) (TSX: HEXO), Cronos Group Inc. (NASDAQ: CRON), Aleafia Health (OTCQX: ALEAF) (TSX-V: ALEF), and The Supreme Cannabis Company Inc. (OTCQX:SPRWF) (TSX:FIRE).

The Yield Growth Corp. (CSE:BOSS)

(OTCQB:BOSQF) The Yield Growth Corp. announced that it has entered into a letter of intent to license the worldwide rights for 8 cannabis product topical formulas to Antler Retail Inc. Antler’s California subsidiary previously acquired licenses for 56 product formulas for the California market from Yield Growth. After developing testing and packaging plans with Yield Growth, Antler now wishes to expand its license for 8 of the products for the territory of the world. The fee of $800K payable to Yield Growth will provide worldwide licensing rights to the following men’s products developed by Yield Growth: hair pomade, beard oil, shaving cream, deodorant and 4 essential oil colognes. Yield Growth anticipates it will generate additional revenues through the license as the LOI contemplates that Yield Growth will provide packaging, marketing, manufacturing and distribution services to Antler for the men’s line. The LOI contemplate that the license fee may be paid in stock but other fees are to be paid in cash on a monthly basis. Antler is a related party to Yield Growth, as Krystal Pineo and Penny Green are both directors and significant shareholders of Yield Growth and Antler. The LOI anticipated that a definitive agreement will be entered into within 3 weeks and closing of the transaction will occur by August 31, 2019. FOR MORE INFORMATION ON BOSS/BOSQF, PLEASE VISIT: https://yieldgrowth.com/

Other cannabis-related developments from around the markets include:

HEXO Corporation (NYSE:HEXO)(TSX:HEXO) has received a medical cannabis installation license. The license, issued by the Greek government, will allow HEXO MED to establish cultivation, processing and manufacturing facilities in the region of Thessaly, Greece. With HEXO Corp’s experience in the industry, HEXO MED is poised to become a leader in the European cannabis landscape. “This is a major step for HEXO as we continue to execute towards becoming a top three global cannabis company,” said Sebastien St-Louis, HEXO Corp CEO and co-founder. “Receiving licensing in Greece will allow us to bring know-how and brands powered by HEXO to the European market. The new facility will also drive value for current and future Fortune 500 partners by giving them access to licensed infrastructure internationally with the vision of capturing first-mover advantage in the burgeoning European cannabis market.”

Cronos Group Inc. (NASDAQ:CRON) just announced it entered into an agreement to acquire an 84,000 square foot GMP compliant fermentation and manufacturing facility in Winnipeg, Canada from Apotex Fermentation Inc. The state-of-the-art facility, which will operate as “Cronos Fermentation”, includes fully equipped laboratories covering microbiology, organic and analytical chemistry, quality control and method development as well as two large scale microbial fermentation production areas with combined production capacity of 102,000L, three downstream processing plants, and bulk product and packaging capabilities. “This acquisition will provide the fermentation and manufacturing capabilities we need to capitalize on the work underway with Ginkgo once the milestones under that partnership are achieved,” said Mike Gorenstein, CEO of Cronos Group. “Together with Ginkgo, we are bringing innovation and the power of biological manufacturing to the cannabis industry, aiming to allow for cannabinoid production at large scale and with greater efficiency than is currently possible with traditional cultivation and extraction. We continue to be very excited about the opportunities ahead.”

Aleafia Health’s (TSX-V:ALEF)(OTCQX:ALEAF) wholly-owned subsidiary, Aleafia Farms Inc., secured a License Amendment under Health Canada’s Cannabis Regulations authorizing cannabis cultivation for the entirety of the Company’s Port Perry Outdoor Grow facility. The License immediately increases the Company’s licensed and operational outdoor cultivation area from 292,000 sq. ft. to over 1.1 million sq. ft. As previously announced on June 10, 2019, Aleafia Farms received approval for cultivation in Zone 1 of the Outdoor Grow facility, and days later completed the planting of Canada’s first legal, large-scale outdoor crop. The License now adds Zones 2, 3 and 4 which encompasses the full 1.1 million sq. ft. cultivation area. The License is effective as of July 12, 2019 and expires on October 13, 2020. The Company expects to commence planting the newly licensed area on July 15, 2019, using approximately 7,000 cannabis plants currently growing in pots in Zone 1. The Outdoor Grow operation will be overseen by Aleafia Health’s proven, experienced cultivation team, which together have led the build-out and operations of seven cannabis cultivation facilities. “The immediate four-fold increase in Aleafia Health’s licensed and operational cultivation area is our most significant milestone to date,” said Aleafia Health Chairman Julian Fantino. “We will continue to lead the way in low-cost production. This exponentially increases our total cultivation footprint while securing and increasing product supply for medical cannabis patients.”

The Supreme Cannabis Company Inc. (TSX:FIRE)(OTQXC:SPRWF) announced the launch of Supreme Heights, an investment platform based in London, UK focused on opportunities in the UK and Europe’s CBD health and wellness space. Supreme Heights intends to make strategic investments in and provide support services to differentiated high-growth health and wellness businesses with focused brands and premium CBD offerings. Supreme Cannabis has launched Supreme Heights as a separate entity that will solely address opportunities in the UK and Europe’s CBD health and wellness market. Supreme Heights will benefit from Supreme Cannabis’ regulatory, product commercialization, supply chain, marketing and capital markets expertise and corporate support services. Supreme Cannabis’ management team has immense experience supporting health and wellness companies operating in Canada and international markets. Supreme Heights will draw on the Company’s experience launching premium brands.

“The rapidly evolving CBD markets in the UK and Europe present compelling investment opportunities given the promising environments for new health and wellness companies to establish differentiated brands and capture meaningful market share. Supreme Heights is positioned to quickly act on attractive opportunities and establish an early mover advantage in the space,” said Navdeep Dhaliwal, CEO of Supreme Cannabis. “Supreme Heights will benefit from our experience launching some of the most premium cannabis brands in Canada and from the strong leadership and the deep industry connections of our UK partners. We look forward to driving value for Supreme Cannabis shareholders through this investment platform.

Source: PALM BEACH, Florida, July 25, 2019 /PRNewswire

DISCLAIMER: FN Media Group LLC (FNM), which owns and operates Financialnewsmedia.com and MarketNewsUpdates.com, is a third- party publisher and news dissemination service provider, which disseminates electronic information through multiple online media channels. FNM is NOT affiliated in any manner with any company mentioned herein. FNM and its affiliated companies are a news dissemination solutions provider and are NOT a registered broker/dealer/analyst/adviser, holds no investment licenses and may NOT sell, offer to sell or offer to buy any security. FNM’s market updates, news alerts and corporate profiles are NOT a solicitation or recommendation to buy, sell or hold securities. The material in this release is intended to be strictly informational and is NEVER to be construed or interpreted as research material. All readers are strongly urged to perform research and due diligence on their own and consult a licensed financial professional before considering any level of investing in stocks. All material included herein is republished content and details which were previously disseminated by the companies mentioned in this release. FNM is not liable for any investment decisions by its readers or subscribers. Investors are cautioned that they may lose all or a portion of their investment when investing in stocks. For current services performed FNM expects to be compensated twenty-five hundred dollars for news coverage of the current press release issued by The Yield Growth Corp. by a non-affiliated third party. FNM HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E the Securities Exchange Act of 1934, as amended and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. “Forward-looking statements” describe future expectations, plans, results, or strategies and are generally preceded by words such as “may”, “future”, “plan” or “planned”, “will” or “should”, “expected,” “anticipates”, “draft”, “eventually” or “projected”. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a company’s annual report on Form 10-K or 10-KSB and other filings made by such company with the Securities and Exchange Commission. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and FNM undertakes no obligation to update such statements.

Contact Information:

[email protected]

+1(561)325-8757

Source: Financialnewsmedia.com

Stocks to watch

DO YOUR RESEARCH BEFORE INVESTING IN CANNABIS COMPANIES

APHRIA’S $70 MILLION CASH WINDFALL IS A PRODUCT OF ITS STILL-UNEXPLAINED PAST

Published: Aug 14, 2019 12:07 p.m. ET

by Max A. Cherney

Aphria says it has no plans to release line-by-line rebuttal of short seller report

A look at cannabis producer Aphria Inc.’s stock since it released its annual report suggests something of a turnaround.

After a surprise profit, Aphria’s APHA, -6.86% APHA, -6.56% U.S.-traded shares rallied 40% in a single day, adding over half a billion in market value to the name. It has since retreated, shedding $200 million in just over a week’s worth of trading.

Aphria appears as if it’s running as it should. The way the freshly installed chief executive tells it, one reason for the company’s success is that its brands are resonating with customers: high potency for a low price gets marijuana into a lot of hands.

“It comes back to being a low-cost producer — from a grow, to a production standpoint,” CEO Irwin Simon told MarketWatch last week. Simon until last year ran Hain Celestial Group Inc. HAIN, -4.49%, a food-oriented consumer packaged goods company which he founded in the 1990s. “You can’t really market your brands here, so how do you get consumers to try them? I want to get the brand in a lot of consumers’ hands.”

Yet Aphria has an ugly history that it has not entirely dispensed with — and will not vanish until October at the earliest. Its C$89 million ($70 million) windfall was a partial result of deal-making designed to enrich insiders at the expense of shareholders on both sides of the border. The new CEO Simon has also asked investors to accept a wildly optimistic projection for Aphria’s ability to sell cannabis. And he has asked investors to take in good faith an adjusted financial figure in lieu of profits that resembles his own history of using adjusted numbers to cut management bonus checks and present results that don’t track with what U.S. regulators demand.

In December, short sellers Hindenburg Research and Quintessential Capital Management made the case that Aphria executives had used a complex set of financial maneuvers to enrich insiders and associates by overpaying for assets held by friendly parties, including a stake in a little-known shell company. Former CEO Vic Neufeld and Co-Founder Cole Cacciavillani stepped down and the company promised an internal investigation by an independent committee and a point-by-point rebuttal of the accusations.

Aphria’s investigation is complete, but the public has not yet seen a rebuttal.

Despite dozens of media reports of the company’s promise, an Aphria spokeswoman denied that the company had promised investors that it would issue a line-by-line rebuttal to the short seller claims. Ex-CEO Neufeld made the promise of a rebuttal and not the company, she said.

See also: The ‘hostile’ takeover offer for cannabis company Aphria is littered with red flags

As shares were slammed in the wake of the short sellers’ report, a U.S. company that was little more than an idea on a napkin a year ago launched a takeover bid for Aphria. Now known as Green Growth Brands GGBXF, -2.68% GGB, +0.00%that company’s failed bid for Aphria battered the stock price in both directions. Green Growth listed on the Canadian Securities Exchange, buying into the shell company Aphria already owned, which has proven lucrative for Aphria, though it’s more difficult to figure out how it benefits shareholders.

In April, Aphria executives said that in conjunction with terminating the Green Growth takeover, Aphria would receive C$89 million ($70 million) for its shares through an investment vehicle that Aphria has a stake in, a stake that got more valuable after Green Growth made its takeover bid for Aphria. Aphria disclosed receiving the first C$50 million in April and agreed to take C$39 million due in the fall.

But it was hard to tell exactly how that payment contributed because Aphria — like several other Canadian companies and U.S. businesses traded over-the-counter — did not include a full set of quarterly financial tables with its year-end results released earlier this month. The company told MarketWatch that it did not use the cash to juice its fourth-quarter profits, but rather added the payment to the balance sheet and excluded it from the income statement altogether.

Aphria stock is cross-listed on the New York Stock Exchange, which should lead to greater disclosure than over-the-counter peers. One of the reasons for Aphria’s American listing is the obvious hope it can attract the valuable dollars of U.S. retail investors, but also snag the nearly-impossible-to-attract institutional money that has largely stayed away from the cannabis industry.

Read: Short sellers are increasing bets that cannabis stocks will fall

Tilray Inc. TLRY, -13.26% avoided similar issues for American investors by listing on the Nasdaq, reporting with U.S. accounting standards and accepting Securities and Exchange Commission oversight. Canopy Growth Corp CGC, -7.14%WEED, -7.08% the world’s largest pot company backed by Constellation Brands Inc. STZ, -1.81% seems to understand the importance of bowing to the will of American investors too. In its recent earnings call, former Constellation executive and now Chief Financial Officer Mike Lee, said it would soon report in U.S. generally accepted accounting principles.

Aphria could do the same thing.

The hardest thing to understand about Aphria’s results wasn’t buried in an arcane footnote to the financial statements or obfuscated by holding companies and attorney jargon. It was that executives boasted over the course of the coming fiscal year that the company would collect as much as C$700 million in revenue, half of which would be from cannabis sales.

To accomplish the task may require more than 150% revenue growth from recreational cannabis for four quarters in a row. It’s hard to understand exactly how Aphria plans to do that. Simon acknowledged that the company’s fattest margin producer, top-shelf pot brand Broken Coast, is at capacity, and to add to it would require at least two years of work, according to its regulatory filings.

In the fourth quarter, the company disclosed that it sold C$28.6 million of pot, with about C$18.5 million stemming from adult recreational sales in Canada, or about C$74 million in annualized sales. In the prior quarter, it sold C$7.19 million worth of recreational pot and just over C$10 million in medical sales.

To hit its target Aphria will have to grow recreational revenue by a multiple of four, assuming medical revenue stays relatively flat, and there is little to suggest it will be able to expand quickly enough to make that happen. Macgregor, the Aphria spokeswoman, says that Aphria‘s forecast is tied to the company’s expectations of when Health Canada will license its Aphria Diamond facility’s further expansion plans and its other already licensed expanded facilities.

If Aphria decides to try to buy additional capacity, that would likely be a problem. Though CEO Simon touted the company’s war chest, it could be competing in the acquisition market against the likes of deep-pocketed Altria Group Inc.MO, -1.43% -backed Cronos Group Inc. CRON, -5.01% , CRON, -4.68% Tilray and its IPO war chest, and Canopy Growth, with its $4 billion investment from Corona beer distributor Constellation Brands STZ, -1.81%. It’s hard to see where Aphria could buy more revenue, even from a problematic set of greenhouses that CannTrust Holdings Inc. CTST, -4.26% TRST, -3.72% owns.

While working toward that revenue goal, Aphria could look to coast on its profitable fourth quarter, which some declared the first big pot company since recreational weed sales began in Canada. As Aphria says, its profits aren’t the result of the C$50 million from Green Growth — but the bottom line is obfuscated by a series of adjustments: C$40 million in “nonoperating” gains from changes in value of its convertible debt, foreign exchange and other items.

Aphria also used this carefully selected financial information packaged into familiar jargon — earnings before taxes, interest, depreciation and amortization — to maintain the appearance of profitability. Ebitda is already an adjusted number, so the term “adjusted Ebitda” is an adjustment of an adjusted number. Welcome to pot stocks, enjoy the adjusted Ebitda.

CEO Simon himself is no stranger to inventing new ways to describe profits. While running Hain Celestial, Simon asked investors to monitor “adjusted net income,” removing items that appeared central to his strategy of rolling up niche organic-food businesses. The tactic appears to have obfuscated the company’s profits and issues surrounding the company’s distributor discounts, which came to a head several years ago, forced Hain to delay its financial results (Ultimately the company concluded there was no wrongdoing and the resulting adjustment had no “material” impact on its finances). After an activist investor insisted on board changes, Simon departed the company more than a year later.

Regardless of Simon’s past creative definitions of profit, weed companies such as Aphria have taken to using it as a substitute for standard figures and are expanding its definition to include accounting that goes well beyond what the acronym typically includes. And because it’s not an accounting principle recognized on either side of the border, cannabis companies are free to define it how they please.

Simon says: let there be profit. Maybe so. Until there isn’t.

Source: MARKETWATCH

photo: MarketWatch

Cannabisness Of Beauty is published by Cheryl Green

owner of Green Creative Group LLC,

a M/WBE certified company