by Bill Peters | 12/26/2019

Following 2019’s collapse in marijuana stocks, some of the most well-known pot companies in the U.S. and Canada just don’t have enough money in the bank to get through the next 12 months without big changes, some analysts estimate.

Last year was a bubble year of money-raising and boilerplate talk of “disruption.” But if 2019 was the year marijuana stocks’ bubble popped, 2020 seems likely to be the year when investors have to pick through, and make sense of, whatever smaller industry remains on the other side after companies go under or get sold for parts.

The cleanup won’t end there. Figuring out how to dismantle companies that run out of cash in 2020 will be just the start of a new, separate drama.

More industry observers wonder what recourse — in court or otherwise — cash-thin companies will have as doors to financing slam shut and debt comes due. With private equity circling, they also wonder whether a bigger sweep-up of “distressed assets” is coming.

During a marathon four-hour panel with Cowen & Co. at MJBizCon this month, there was talk of “those of us that make it through the next 12 months.”

Also at the marijuana industry’s biggest event, Codie Sanchez, managing director at cannabis private equity firm Entourage Effect Capital, said companies needed to make sure they had 12 months of cash on hand “to weather the storm.“

“There will be a distinction that will become increasingly obvious, I think, over the next 12 to 24 months,” Cam Battley, Aurora Cannabis‘ (ACB) then-chief corporate officer, said in an interview at the conference in Las Vegas’ Cosmopolitan hotel. “And we will end up at the end of that period with a smaller number of cannabis companies in Canada, in the U.S., and perhaps other parts of the world than we have today.”

A little more than a week later, Aurora said that Battley had left that position. Aurora cannabis stock sank on the news, amid questions surrounding an abrupt departure.

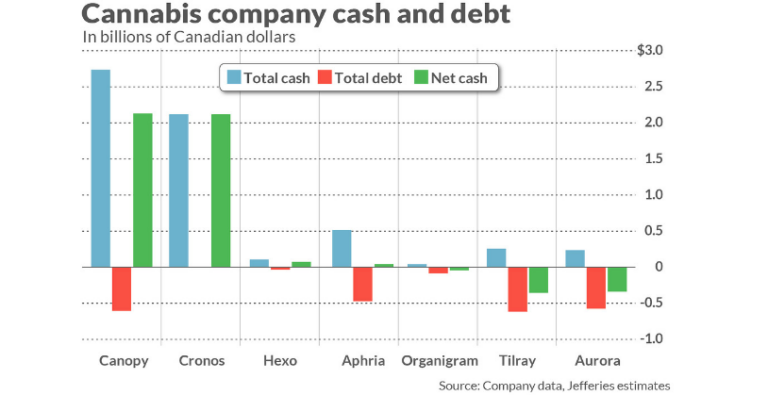

Marijuana Stocks And Available Cash

Even as marijuana stocks continued their exodus lower, some companies are still sitting on a good deal of cash. Cronos Group (CRON) has nearly 15 years’ worth, and Canopy Growth (CGC) has enough to last four-and-a-half years, based on an MJBiz Investor Intelligence analysis. Last year, tobacco giant Altria (MO) invested $1.8 billion in Cronos, and alcohol giant Constellation Brands (STZ) invested $4 billion in Canopy.

(HEXO) and Tilray (TLRY) had 1.2 years’ worth, according to MJBiz Investor Intelligence. CannTrust (CTST) and Aurora Cannabis (ACB) had more than a half-year’s worth.

MedMen (MMNFF) had less than four months’ worth of cash coverage, the analysis found. The company has laid off staff and tamed its multistate ambitions to cut costs. The California-based retailer, however, has a $250 million credit line from private equity firm Gotham Green Partners. But that arrangement has raised questions about how much the private equity firm might control MedMen’s fate. Cronos CEO Mike Gorenstein co-founded Gotham Green.

Acreage Holdings (ACRG), the U.S. cannabis company backed by former House speaker John Boehner, had less than three months. Acreage declined to comment on the analysis. The company has an agreement to sell some properties to a real estate investment trust and then lease them back. That deal, it said, has helped its financial situation.

During its most recent earnings call in November, Acreage said it planned to go “broader and deeper” in every state where it operates. But Acreage’s last quarter was the second in a row during which it did not open any new stores, as it works through regulatory snags in some states. Management in November said it had three completed dispensaries in Massachusetts and one in Michigan. Those are awaiting the OK from regulators.

Marijuana Industry Eyes ‘SAFE’ Haven

To gauge a company’s cash coverage, the MJBiz Investor Intelligence analysis looked at Factset’s operating-cash-flow and capital-expenditures forecasts for the next fiscal year, along with debt due in 2020. It compared that to a company’s cash on the balance sheet as of Dec. 17.

The analysis didn’t factor in big lines of credit. Such loans are rare for the industry as traditional banks stay away.

Congress is trying to change that with the Secure and Fair Enforcement Banking (SAFE) Act, which would allow the cannabis industry to access banking and financial services. The House passed the bill in September, but its prospects are dimmer in the GOP-controlled Senate. Last week, Senate Banking Committee Chairman Mike Crapo, R-Idaho, said he opposes the SAFE Act but is open to amending it to address his concerns.

Meanwhile, companies are finding other ways to obtain cash. Curaleaf (CURLF) last week said it secured $275 million in financing in a syndicated loan provided by institutional buyers. In November, Executive Chairman Boris Jordan said Curaleaf expected to have “very good financing” to announce later in the year. If that didn’t go through, he added that “the large shareholders of the company are more than happy to provide the financing” to seal any deals.

Other Questions For Marijuana Stocks

In addition to the cash crunch, Entourage Effect’s Sanchez said companies need to address three other questions: Are they profitable or do they have a path to profitability? Do investors consider the company one of their top investments? Can they keep up sales even as cannabis turns into more of a commodity?

If the answer isn’t yes to those questions, they might need to think about merging or selling assets.

She could see her firm moving in to turn more “distressed” companies around. Entourage, she said, had two staff members with experience in handling distressed companies. They also had two people who had been entrepreneurs themselves who have pulled companies back from bankruptcy.

At a presentation late last year, she recalled putting up a large sign that said, essentially, prepare for the downturn.

“Because it’s totally irrational how these companies are valuing themselves and what multiples are,” she said at MJBizCon. “The only difference for us is that, now, companies are sort of listening to that.”

Bankruptcy Protection For ‘Illegal Drug Money’?

But since cannabis is still federally illegal, the industry — at least the part of it that directly handles the plant itself — doesn’t have the bankruptcy protections that other businesses do. For companies that don’t directly handle pot, the gray areas are still wide.

“You’re basically asking a federal court to approve a plan that would be funded by what is, in the eyes of the federal government, illegal drug money,” Jonathan Robbins, chair of cannabis practice at the law firm Akerman, said over the phone.

Even ancillary service providers, he said, aren’t guaranteed protection. For landlords that serve the industry, for instance, “the money that would be paid to creditors is still money coming from the marijuana industry. And that’s the dilemma.”

Robbins said other alternatives, albeit weaker ones than federal bankruptcy protection, were still available for the industry. Companies could seek receivership, where a court appointee steps in to oversee company assets and decisions. Assignments for the benefit of creditors, an option similar to bankruptcy, is also available in Florida and other states.

Marijuana Stocks Face Low Prices, Illegal Rivals

Executives dispute the ever-more-audible doom-saying about the marijuana industry. At MJBizCon, a slide during a presentation by equity analysts Craig Behnke and Mike Regan showed the ups and downs of Amazon‘s (AMZN) stock during its two-plus decades as a public company. Amazon shot out of the gate following its debut. Then, it stabbed lower amid the dot-com bust. But it climbed steadily afterward.

“AMZN Timing Right, Then Wrong, Then Right,” the heading of that slide read.

Battley, during the Cowen panel, said that the current industry disarray “not only had to happen,” but was healthy.

But marijuana stocks must still grapple with the reality that much of the demand in the U.S. and Canada has stayed on the illicit market. After years of trying to get high fashion to rub off on cannabis — via $13,000 gold pipes and other accessories — more companies are rolling out low-priced weed to compete.

Canopy, Tilray and Hexo are now launching low-priced weed brands as illegal cannabis keeps prices low. But management for Aurora Cannabis, during its most recent earnings call, said “value brands,” in some cases, were really just “dumping-inventory” brands.

As prices tumble, others warn of the spillover effects up the supply chain. Michael Townsend, co-founder of Hemptown, a hemp cultivator and manufacturer, said more hemp farmers were likely to go bankrupt in 2020. A rush to buy cheap seeds left farmers and processors alike holding weak product. Legal disputes between both sides seem likelier to erupt.

Farmers initially planted when prices of hemp were higher, Townsend said. When it came time to harvest, however, prices caved, as supply flooded the market in an effort to ride the CBD craze. That could make already-high harvesting costs far more difficult to deal with — and potentially not worth it at all.

“I think a lot of farmers are just leaving the hemp in the field,” he said, “and they’ll till it under when it’s rotten.”

YOU MAY ALSO LIKE:

Stock Market Forecast 2020: Clear Skies From Fed, China Trade But Election Looms

Marijuana Stocks To Buy And Watch

Is Canopy Growth Stock A Buy Right Now? Here’s What Earnings, Charts Show

Catch The Next Big Winning Stock With MarketSmith

Best Growth Stocks To Buy And Watch

Source: Investors Business Daily

Stocks to watch