MEET QUATREAU

Canopy Growth's New CBD Sparkling Water Finally Hits The U.S. Market

by Chris Furnari | Mar. 2, 2021

Canopy Growth Corporation, the Canadian cannabis firm backed by New York-based alcohol company Constellation Brands STZ -1%, has officially launched its CBD-infused sparkling waters in the United States.

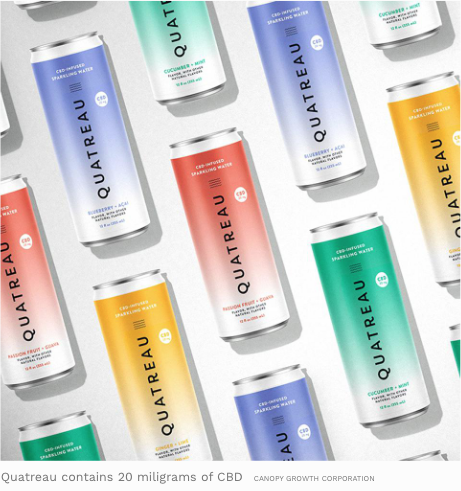

Called Quatreau, the new ready-to-drink beverages come in four flavors — Cucumber + Mint, Passion Fruit + Guava, Ginger + Lime, and Blueberry + Acai — and feature 20 milligrams of hemp-derived CBD per 12 oz. serving.

Unlike Quatreau offerings already available in Canada, the U.S. versions do not include any THC, the psychoactive compound found cannabis.

The drinks are sugar free, contain just 25 calories, and will initially be sold via Canopy’s online store for $3.99 per can. However, broader retail distribution could be announced in the coming weeks.

“We have a great strategic partner in Constellation Brands, which has their ‘gold network’ and is particularly strong at leveraging distributors to reach a wide array of consumers,” said Canopy chief product officer Rade Kovacevic. “I don’t think there’s any doubt we will look at distribution beyond e-commerce.”

Constellation, which makes the Corona, Modelo and Pacifico beer labels, and owns several prominent wine and spirits brands, has already invested more than $4 billion into Canopy Growth. It currently owns 38.6% of the cannabis firm and has the right to acquire another 17.2% of the company, which would bring its total stake to 55.8%.

With the launch of Quatreau, and the forthcoming debut of several THC-infused drinks, Canopy has its sights set on a $200 billion alcohol market and a $20 billion functional beverage market in the U.S., Kovacevic said.

“The opportunity is huge,” he said. “What does it look like if we’re able to disrupt 5% of that? What does it look like if it’s more? It’s an exciting opportunity, especially considering the better-for-you health benefits that these products have compared to their analogues.”

CBD, short for cannabidiol, is the nonintoxicating cannabinoid found in the cannabis family of plants. Proponents of CBD say it reduces inflammation, improves sleep, alleviates stress and helps regulate mood.

However, those claims have not been substantiated by the U.S. Food and Drug Administration (FDA), and the agency has yet to issue final regulatory guidance for products containing CBD.

Nevertheless, several beverage manufacturers have already begun selling their drinks throughout the U.S., pointing to the passage of the 2018 Farm Bill — which removed hemp and its derivatives from the legal definition of marijuana under the Controlled Substances Act — as proof that their products are legal.

“There are no federal laws or regulations prohibiting hemp-derived CBD inclusion in dietary supplements and foods,” Kovacevic said, adding that Canopy is “supporting” Congress and the FDA by sharing its research around safety and proper dosage.

CBD comes in various forms, including edibles, topicals, pills, tinctures, and vapes.

According to Kovacevic, there are over 3,000 CBD brands in the U.S. — including Canopy’s own gummies and pet treats made in collaboration with entrepreneur Martha Stewart.

Market research firm Brightfield Group, which studies the CBD and cannabis sectors, projects the total U.S. CBD market could be worth nearly $17 billion by 2025.

Meanwhile, 86% of U.S. consumers have heard of CBD, according to New Frontier Data, however only 18% have consumed a CBD product.

But as the entire market continues to expand, so too will sales of hemp-infused drinks.

According to cannabis research firm BDSA, sales of hemp-derived CBD beverages are expected to more than double, from about $100 million in 2020 to more than $246 million this year. By 2025, BDSA estimates that U.S. consumers will spend $1.4 billion on CBD drinks at mainstream retail stores.

Hoping to capitalize on that emerging opportunity, major CPG firms like Canopy, Molson Coors TAP 0.0%, and Ocean Spray OCESP 0.0% have jumped into the space, joining popular startups like Recess and Weller which have been working to build the category since 2019.

Molson Coors rolled out its Veryvell line of sparkling waters, which contain 20 mg of CBD as well as adaptogens, in Colorado earlier this year. Ocean Spray also began selling its CarryOn line of CBD sparkling waters, which contain up to 20 mg of CBD, in Colorado last June.

Both companies selected the Centennial State because it has an established regulatory framework that allows for the production, marketing, and sale of CBD-infused products. But Canopy, like others selling directly to consumers, is confident it can distribute to several other U.S. markets.

“We think there’s a fairly clear regulatory path and way to enter the market, and we’re really comfortable with the future opportunity,” Kovacevic said. According to Canopy’s website, Quatreau can be shipped to 32 states. The ability to reach consumers across the U.S. will be key as Canopy tries to establish itself in a category that is becoming increasingly crowded. Kovacevic, citing internal research, said consumers are looking for CBD products like Quatreau to help them “relax” and relieve stress.

“They want to feel confident that CBD is causing the effects, and that there aren’t other ingredients in the product that they are unsure about,” he said. That’s why Canopy is using a CBD isolate, which does not contain other plant compounds.

“It lets us be very specific with consumers in terms of what is in the product and what is on the ingredient panel,” Kovacevic said. In addition to CBD drinks, Canopy is also planning to launch its THC-infused beverages in the U.S. this year through a partnership with New York’s Acreage Holdings. Labels like Tweed and Houseplant, which contain between 2 mg and 2.5 mg of THC and are currently sold in Canada, could find their way to the U.S. this summer. Meanwhile, the Quatreau offerings are being made in the U.S., however a spokesperson for Canopy said Constellation and Acreage are not involved in the production process.

Quatreau labels list Canopy’s U.S. headquarters in Evergreen, Colorado — the former offices of cannabinoid research company Ebbu, which Canopy acquired in 2018 in a cash-and-stock transaction valued at $330 million — but do not specify where the drinks were manufactured.

A certificate of analysis (COA) available on Canopy’s e-commerce site shows that Quatreau products were tested by a laboratory in Burbank, California.

Source: FORBES